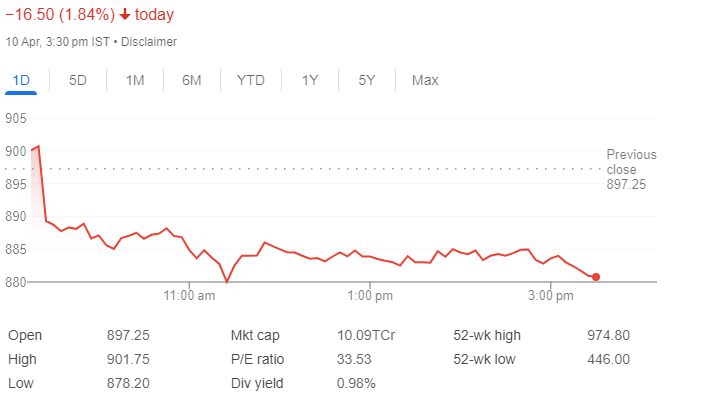

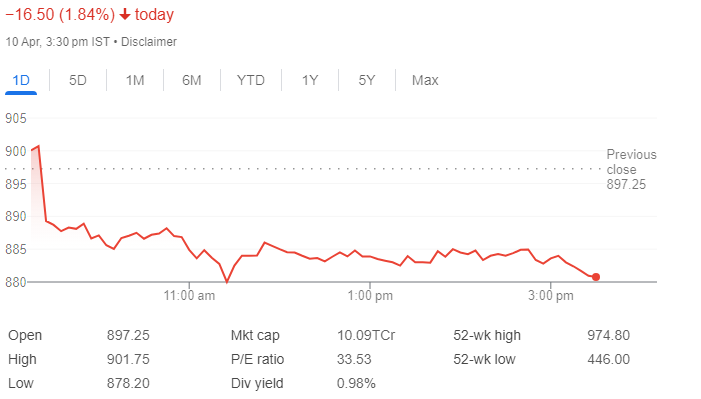

garden reach shipbuilders share price

introduction:

Garden Reach Shipbuilders and Engineers Limited (GRSE) is India’s leading shipyard specializing in the defense industry. Established in 1884, GRSE has a rich legacy of delivering premium ships to the Indian Navy, Coast Guard and commercial customers. The company’s share price is of great interest to investors, analysts and stakeholders. In this blog, we will examine the factors affecting GRSE share price and provide analysis in both English and Hindi.

Historical Features:

Over the years, GRSE share price has fluctuated with the influence of various internal and external factors. A company’s financial performance, order book position, government policies and geopolitical developments play an important role in its stock performance.

Assets of excellence:

GRSE’s journey began more than a century ago when it was founded as a small steamer repair shop. Over the years, the company expanded its operations and expertise, making it one of India’s leading shipyards. GRSE’s heritage is founded on integrity, quality craftsmanship and a relentless pursuit of excellence.

Self-defense ships:

GRSE plays a vital role in India’s defense readiness by manufacturing a wide range of ships for the Indian Navy, Coast Guard and other defense organizations From frigates and corvettes to patrol vessels and landing craft, GRSE incorporates naval vessels designed to meet today’s stringent requirements including combat applications Commercial shipbuilding:

Economic Analysis (Financial):

The financial performance of a GRSE is an important determinant of its share price. Investors pay close attention to metrics like revenue, profitability, and earnings per share (EPS) to assess a company’s health. Additionally, factors such as debt levels, financial position and cash flow get investors’ attention.

Now, let’s calculate the total cost of buying GRSE shares:

Total trading volume (excluding brokerage fees and taxes) = current share price*

share volume Total Transaction Amount = ₹[Enter Share Price] *

[Enter Share Number]. Brokerage Fee = Total Transaction Amount * (Brokerage Fee / 100) .

Brokerage Fee = ₹[Enter Total Cost of Business] *

([Enter Broker Fee] / 100) Total costs (excluding taxes) = total turnover + retail costs Total cost (excluding taxes) = ₹[include total transaction amount] + ₹[include broker fees].

Taxes = Total Spending * (Tax Rate / 100) .

Tax = (₹[enter total cost excluding tax] + ₹[enter broker fees]) * ([enter tax amount] / 100) Total spending = Total spending (excluding taxes) + taxes Total Cost = (₹[Enter All Trading Amount] + ₹[Enter Broker Fee]) + ₹[Add Tax].

Once you have plugged in the respective values for the variables, you will arrive at the total cost of buying GRSE shares. Remember to account for any rounding or adjustments according to the actual brokerage fees, taxes, and other associated costs specific to your business.

To find out the total cost of Garden Reach Shipbuilders and Engineers Ltd. (GRSE) shares, many factors must be considered such as current share price, preferred number of shares, trading costs, taxes, and other associated costs.

Current Share Price:

The first step is to determine the current GRSE share price. This information can be obtained from financial news websites, stock market apps, or directly from a GRSE-listed stock exchange. Let us assume that the current share price of GRSE as on [insert date] is ₹[insert share price].

Number of parts:

Next, you need to decide how many GRSE shares you want to buy. This depends on a variety of factors, including your investment goals, risk tolerance, and available funds. For the purposes of this calculation, let’s assume you want to buy [insert number of shares] of GRSE. Brokerage at: If you are buying shares through a brokerage firm, you will generally receive cash or stock offerings. Brokerage fees vary depending on the broker and the type of account you have. Let’s assume that the brokerage fee to purchase GRSE shares is [insert brokerage fee]% of the entire transaction.

Taxes:

In some states, you may be subject to dividend taxes. The applicable tax rates may vary depending on factors such as investments, holding periods and local tax laws. For simplicity, let’s assume a tax rate of [insert tax rate]% on the entire transaction.

Other associated charges:

Additional costs may include stamp duty, transaction costs and any other fees issued by the stock exchange or regulators. These costs may vary depending on the specific transaction and jurisdiction.

Order Book Status (Order Status):

GRSE’s order book is indicative of its future earning potential. Strong order books indicate greater demand for the company’s products and services, positively affecting investor confidence. Order size, diversity and time frame used are important considerations for investors considering GRSE’s growth prospects.

ICICI Securities has issued a cell call to Garden Reach Shipbuilders & Engineers with a target price of Rs. Currently the market price of Garden Reach Shipbuilders & Engineers Ltd is 763.35 .

Government Policy (Government):

As a defense company, GRSE’s performance is significantly influenced by government policies and defense spending. Changes in defense budgets, procurement policies and strategic plans affect the GRSE business